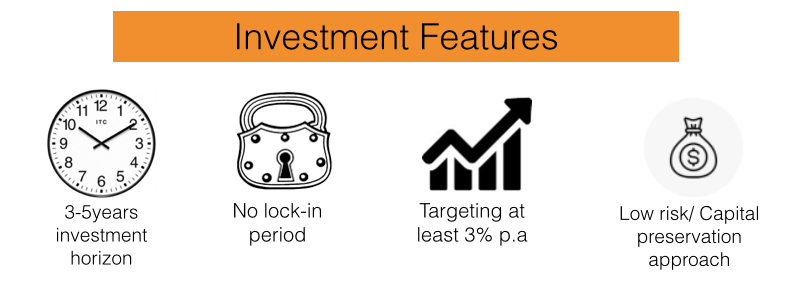

UOB Asset Management’s bond investment team is an award winning one. They have launched a new bond fund that can deliver at least 3% p.a in dividend returns to you while being stable and low risk.

I would buy this investment if these features are what I need.

If you have saved up for a second property or your insurance policy has matured, use those amounts for this investment and you can start building dividend passive income. Although it is not risk free, this investment even stands well against popular dividend saving accounts like the OCBC 360 or the UOB One account etc.

How much passive income will I get?

It pays 3-4%pa in total and dividends are actually paid out monthly a 0.29%-0.33%. That means for every $20,000 invested, an average of $60/month passive income.

Basic details of the fund

- Absolute return of 3%pa. This is the fund manager’s KPI.

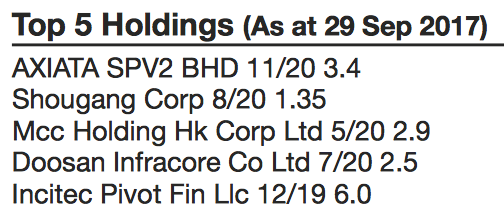

- Top bond holdings of fund. Mostly short duration bonds.

How are the dividends given to me earned in the first place?

The fund buys into bonds which are “IOU” to companies. If the bonds do not default, the principle is returned to the fund. Along the way, coupons paid by the bonds will be given back to you as dividends. 70% of the holdings are invested into Asian short duration bonds (Average yield to maturity of 2.74%) and around 30% towards Asian High Yield bonds (Average yield to maturity of 5.54%).

Subsequently, the fund manager will add individual bonds into the portfolio. This flexibility in mandate is really useful because some good opportunities involve bonds that are unrated and did not previously allow the fund manager from UOB to buy for us. Now, this fund can acquire up to 20% on individual bond opportunities.

With a small fund size now, any good opportunities picked up will drive up fund performance.

Ready to invest? Click here to “Contact Josh Tan”.

Image credits: Fund Prospectus